FAFSA: An Important First Step

To determine most equitably the distribution of funds for financial aid, Davenport University requires all students applying for assistance to complete a Free Application for Federal Student Aid (FAFSA). This is a federal government form and it establishes eligibility for assistance from federal and state governments as well as from Davenport University. The FAFSA is free and a student should never be asked to pay a fee to complete the FAFSA. To be eligible for financial aid, students must be citizens of the United States or eligible non-citizens and must be seeking a degree or certificate in a program that is at least 24 semester credits and 30 weeks (two semesters) in length. Students enrolled in shorter programs, in programs leading to specialty certificates, or in other specially designed series or groups of courses are generally not eligible for financial aid. Students must also meet standards of academic progress in their courses of study to maintain eligibility. Students must complete the FAFSA each academic year to determine continued eligibility for most programs. Audited classes cannot be used to determine eligibility for financial aid. The Davenport website has information about financial aid resources and the financial aid process. In addition, student financial counselors are available by calling 1-866-774-0004 or sending an email to financialservices@davenport.edu.

Determination of Awards

Most aid dollars are awarded on the basis of a congressional formula that calculates each family’s aid eligibility. The Student Aid Index (SAI) is an eligibility index number that your college’s or career school’s financial aid office uses to determine how much federal student aid you would receive if you attended the school. This number results from the information that you provide on your FAFSA® form. This number is not a dollar amount of aid eligibility or what your family is expected to provide. A negative SAI indicates the student has a higher financial need. Learn how the SAI is calculated.

The college or career school will determine your financial need by subtracting your SAI from the cost of attendance.

The FAFSA Simplification Act replaced the Expected Family Contribution (EFC) with the SAI. Learn more about the changes with the 2024-25 FAFSA form.

Your SAI will be listed on your FAFSA Submission Summary. Before completing the FAFSA form, use the Federal Student Aid Estimator to estimate your SAI.

See the Davenport website for current tuition, fees and Financial Aid information.

The cost of attendance budget is set by the University and reflects modest indirect costs (books, travel, technology, and personal expenses) beyond the standard tuition, fees, housing, and food charges. A student’s financial need figure results from the difference between “Cost of Attendance” and the “Student Aid Index.”

Student Financial Aid Rights and Responsibilities

The Student Financial Services Office staff is committed to assisting students in understanding the student financial aid programs and policies. Knowing these rights and responsibilities puts students in a better position to make decisions about educational goals and how to achieve them.

Students have the responsibility to know about and do the following:

- Be enrolled in an eligible program leading to a degree or diploma before receiving federal aid

- Complete all applications accurately and submit them on time to the correct place

- Be aware of and comply with the deadlines for application or re-application for financial aid

- Return, in a timely manner, all additional documentation, verification information, corrections, and/or new information requested by either the Student Financial Services Office, The Michigan Department of Lifelong Education, Advancement, and Potential, or the agency to which the application was submitted

- Be aware of the school refund, standards of academic progress, and withdrawal policies as found in this school catalog, schedules, and financial aid notifications

- Be aware that no adjustments to charges-tuition, fees, books, etc.-are made for students who stop attending without official notice of withdrawal made to Advising (see specific refund grids published each semester)

- Be aware that withdrawal from all classes before the 60% point in time of the semester/session requires the University to calculate an amount to be returned to the federal aid programs

- Be aware that if the amount of federal aid disbursed exceeds the amount of federal aid earned as of the date of withdrawal, either the University, or the student, or both are required to return some portion of federal aid to the federal government

- Understand that at the end of every semester/session, for students who withdrew unofficially from the University (that is, stopped attending before the end of the semester), a calculation of return of federal funds may be required, if their documented last day of attendance, as reported by the faculty, is before the 60% point in time of the semester/session

- Provide correct information (in most instances, misreporting information on financial aid application forms is a violation of federal law and may be considered a criminal offense under the U.S. Criminal Code)

- Read, understand, and keep copies of all forms for which the student supplies a signature

- Comply with the terms of all agreements that are signed

- Register for all classes that the student will be attempting during any one semester, before the final date to register for classes

Students have the right to know the following:

- What financial aid programs are available

- The deadlines for submitting applications for each of the available financial aid programs

- How financial aid will be distributed, how decisions on that distribution are made, and the basis for those decisions

- How financial aid is determined (this includes knowing the basis for the cost of attendance budget and how these budgets were determined: tuition, fees, housing and food, transportation, books and supplies, technology, and personal and miscellaneous expenses)

- How much financial need has been met, as determined by the institution

- An explanation of the various programs in their financial aid package

- The school refund policy as stated in this University catalog

- How the school determines standards of academic progress and the consequences of failure to meet these standards

- What portion of the financial aid received must be repaid and what portion is gift aid; and if they receive a loan, the right to know the interest rate, the total amount that must be repaid and the repayment procedures, the length of time they have to repay the loan, and when repayment is to begin.

Contact the Student Financial Services Office for additional information.

Description of Financial Aid Programs and Services

Federal Gift Aid

Federal Pell Grant

Gift assistance based on need awarded through the federal government. The amount changes annually, based on appropriations. Students must apply by filing the FAFSA.

Federal Supplemental Educational Opportunity Grant

Students must apply for this federal gift assistance by filing the FAFSA. Preference is given to those applicants with exceptional financial need. The amounts are awarded based on the funds available.

State of Michigan Gift Aid

The awards through these programs are contingent on funding set by the State Legislature. If the State reduces or eliminates the award, students will be responsible to pay the balance. Davenport will provide updates via University Communications throughout the year as new information comes from the State government.*

Michigan Achievement Scholarship (MAS)

The Michigan Achievement Scholarship provides renewable scholarships for undergraduate students who graduate from high school in Michigan with a diploma, certificate of completion, or achieved a high school equivalency certificate in 2023 or after. Students must be attending an eligible Michigan postsecondary institution. Students must demonstrate financial need when they complete the Free Application for Federal Student Aid (FAFSA) by having a Student Aid Index (SAI) of $35,000 or less. High School graduates from 2023 who received a payment in award year 2023-2024 may be eligible to receive MAS for award 2024-2025 with a SAI higher than $30,000. Students must be enrolled full-time as determined by the participating institution. Students must be a Michigan resident since July 1 of the previous calendar year. If a dependent student, parent must also be a Michigan resident since July 1 of the previous calendar year. Students must be a U.S. citizen, permanent resident, or approved refugee. MAS is awarded based on the amount determined by the state. Davenport must be listed as the first college choice on the FAFSA.

Michigan Competitive Scholarship (MCS)*

The Michigan Competitive Scholarship (MCS) program is based upon the ACT/SAT test students take in high school and demonstrated financial need. Students must apply by completing the FAFSA before the priority deadline of May 1. Eligibility is limited to 10 semesters and within 10 years of high school graduation. Davenport University must be listed as the first college of choice on the FAFSA. Students enrolled at least half-time are eligible if need is established and students must maintain a CGPA of 2.0 or greater. Michigan residency is required from July 1 of the year before enrollment. MCS is awarded based on the minimum amount set by State law. The Michigan Department of Lifelong Education, Advancement, and Potential sets the final amount generally in late July, after the State budget is approved. Once Michigan Department of Lifelong Education, Advancement, and Potential sets the final award amount, Davenport updates student awards to match the new amount.

Michigan Tuition Grant (MTG)*

Michigan residents are awarded Michigan Tuition Grant (MTG) solely on the basis of need and is available only at independent Michigan colleges and universities. Students must apply by completing the FAFSA by May 1. Davenport University must be listed as the first college of choice on the FAFSA. No minimum grade point average is required but students must meet standards of academic progress. Students enrolled at least half-time are eligible if need is established. Students must reapply each year. Michigan residency is required from July 1 of the year before enrollment. MTG is awarded based on the minimum amount set by State law. The Michigan Department of Lifelong Education, Advancement, and Potential sets the final amount generally in late July, after the State budget is approved. Once Michigan Department of Lifelong Education, Advancement, and Potential sets the final award amount, Davenport updates student awards to match the new amount.

Tuition Incentive Program (TIP)*

Davenport University fully participates in the Tuition Incentive Program (TIP) administered through The Michigan Department of Lifelong Education, Advancement, and Potential. This program was designed to promote high school completion by providing assistance for tuition and fees to eligible lower-income students enrolled in a certificate or an associate degree program.

To qualify, students must fulfill the following conditions:

- Be a U.S. citizen or resident alien and resident of the state of Michigan.

- Be identified as Medicaid eligible by the Michigan Department of Human Services.

- Have completed high school requirements before reaching 20 years of age.

- Be enrolled at least half-time during the academic year and pursuing a certificate or an associate degree.

- Must complete the acceptance form mailed to them before graduation from high school.

- Initiate enrollment at a participating college within four years after high school graduation or GED completion. All benefits must be used within 10 years after high school graduation or GED completion.

- Must complete the Free Application for Federal Student Aid (FAFSA).

Eligible students may qualify for funding through the TIP program. Those interested should contact the Student Financial Services Office for additional information or call the TIP information number at (888) 447-2687.

Michigan Future Educator Fellowship

The MI Future Educator Fellowship provides financial assistance to our future educators who are admitted and enrolled in an Educator Preparation Program (EPP) approved by the Michigan Department of Education (MDE). Students must complete an annual application. To complete the application or check the status, the student can log into the MiSSG Student Portal at michigan.gov/missg. Students must also complete a Free Application for Federal Student Aid (FAFSA). Applications open May 1 of each year and are open until July 15 of the following calendar year.

To be eligible for an award, a student must:

- Complete the annual MI Future Educator Fellowship application.

- File a current year FAFSA.

- Be a high school graduate.

- Be admitted into an eligible Educator Preparation Program.

- Be working on their initial teacher certification.

- Be enrolled in enough coursework to be considered enrolled full-time during the academic year.

- Have reached Junior grade level according to the institution’s definition.

- Have a cumulative grade point average (GPA) of at least 3.0.

- Be a Michigan resident as defined by the FAFSA.

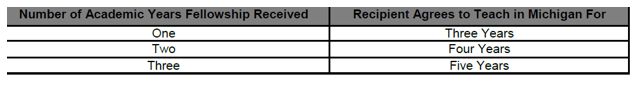

- Complete a Commitment to Teach in Michigan Agreement, which requires that the recipient teach in Michigan in a public school or qualifying public preschool program for a specific number of years, depending on the number of years they have received the MI Future Educator Fellowship.

If the recipient does not fulfill their Commitment to Teach in Michigan Agreement, the MI Future Educator Fellowship converts to a 0% interest rate loan which must be repaid within ten years of the loan conversion, plus any periods of deferment as approved by Treasury.

Students can receive the Fellowship for up to three years. Annual applications are required. To continue to receive the Fellowship, students must meet the requirements for an initial award, plus the following:

- Maintain full-time continuous enrollment in an eligible educator preparation program, as determined by the educator preparation program, or the equivalent of full-time participation for individuals enrolled in an alternative certification program.

- Be maintaining Satisfactory Academic Progress (SAP).

- Have participated in relevant academic and career advising programs offered by the institution.

Awards are restricted to tuition and required fees and pay up to a maximum of $10,000 per academic year at participating institutions. It is the responsibility of the financial aid office to coordinate all sources of aid for which a student may be eligible. Other gift aid may reduce or cancel this award.

Students may receive assistance for up to three academic years and a total of $30,000. MI Future Educator Fellowship is available on a first-come first-served basis. Current and future awards are subject to approved and available funding.

Other State Programs*

Please review State of Michigan Financial Aid web page for more details on the programs noted above as well as any other aid programs that may be offered by the state. Students can also review all the programs offered by the state of Michigan here.

*All Michigan awards are contingent on budgeted appropriation and funds available.

Student Employment

During the academic year, Davenport University students may hold part-time jobs on campus or off-campus at community service organizations. These positions are funded by institutional monies and the Federal Work-Study Program. Open work-study positions will be posted on Handshake. The average workload varies by position. Students are paid on a biweekly basis as wages are earned. Eligible students must demonstrate financial need through the FAFSA and are encouraged to apply for a student employment position on Handshake. If you are unsure of your eligibility for workstudy funds, you will be advised of such eligibility during the hiring process. Students may also contact the Student Financial Services Office or visit Career Services to request an eligibility check and start the employment process. Off-campus employment may be non-need based and is coordinated through the Career Services Office at your campus.

Educational Loan Programs

Davenport University participates in the Federal Government’s Direct Lending program for student loans. Repayment does not begin until six months after graduation, withdrawal from the University, or dropping below six credit hours of enrollment, whichever comes first. Before deciding whether to accept a loan, students should carefully read the section below, which describes the loan that may be offered. Davenport University urges students not to accept a loan for an amount larger than absolutely necessary and encourages them to consider both part-time employment and reducing personal expenses as a means of keeping aggregate loan debt to a minimum. If students do not complete the loan period, they may no longer be eligible for the entire loan amount.

The University requires online entrance interviews for all first-time Davenport University borrowers. The University will provide exit counseling materials to all federal loan borrowers who drop below half-time attendance, to explain their repayment options and responsibilities. The maximum aggregate debt for an undergraduate, dependent student is $31,000 and $57,500 for an undergraduate, independent student. This amount is a combination of subsidized and unsubsidized loans. The subsidized amount by itself cannot exceed $23,000.

PROGRAMS LESS THAN ONE YEAR IN LENGTH

For certificate and diploma programs that are less than one academic year in length (24 semester credits), loan eligibility is reduced. Please contact the Student Financial Services Office for more information about your specific program of interest.

TRANSFER STUDENTS/PRIOR ATTENDANCE

When a student begins attendance at Davenport University after having attended another postsecondary institution within the last calendar year, student loan eligibility may need to be reduced, based on the amount borrowed at the prior institution(s). Please contact the Student Financial Services Office for more information.

Federal Direct Subsidized Loan

The Federal Direct Subsidized Loan is an educational loan for students enrolled at least half-time. Financial need is a requirement. The maximum loan amount for freshmen is $3,500; for sophomores, it is $4,500. The maximum for juniors and seniors is $5,500. Interest rates change annually effective each July 1st. Repayment normally begins six months after half-time enrollment ceases. The standard length of the repayment period is 10 years; this can be extended to 25 years for qualifying students. Please refer to the “Loan Fees and Interest Rates” section of the Financial Aid section of the Davenport website.

Federal Direct Unsubsidized Loan

Students who may not qualify for a Federal Direct Subsidized Loan or who qualify for only a partial Federal Direct Subsidized Loan may qualify for educational loans not based on financial need, such as the Unsubsidized Direct Stafford Loan. The same terms and conditions as for the Federal Direct Subsidized Loan apply, except the borrower is responsible for interest that accrues while in school. Interest rates change annually effective each July 1st. Depending upon their eligibility, students might receive both Subsidized and Unsubsidized Direct Stafford loans totaling up to the applicable loan limit.

- Dependent students may borrow an additional maximum of $2,000 per loan period.

- Independent students may borrow an additional maximum of $6,000 as freshmen or sophomores.

- The maximum for independent juniors and seniors is $7,000.

Federal Direct PLUS Loan

PLUS loans are educational loans not based on financial need that are available to parents of dependent students who have no adverse credit history. Parents may borrow up to the maximum cost of education minus estimated financial assistance per dependent at a fixed rate of interest and a loan fee. Interest rates and loan fees change annually. Please refer to the “Loan Fees and Interest Rates” web page. Repayment begins within 60 days after the final loan disbursement is made. Under some circumstances, parents may postpone repayment of principal and interest through deferment or forbearance. In a standard repayment plan, parents may have up to 10 years for repayment.

Other Loan Information

Alternative Loans

Many alternative educational loans are available. These are consumer loans, not federal aid, and may have income requirements and credit checks. Contact the Student Financial Services Office for more information on alternative loans or the Elm Select website. Students have the right to choose any lender who participates in alternative student loans.

Default and Overpayments

Students who owe an overpayment or are in default on any Federal Loan, which includes Guaranteed Student, Stafford, SLS, PLUS, NDSL, or Perkins loans, will be denied financial aid. The University also has the right to deny admission to any student who is in default on any Federal Loan.

Financial Aid Services

Many scholarship search services are available online. Davenport has compiled a number of web links and information about agencies that provide information about financial aid. This information is under the “Government resources for financial aid planning” heading in the financial aid section of the Davenport website. Students should be very careful using online search engines and perform due diligence whenever using online searches so as to protect their identity. There are many free search options so students should never pay for scholarship searches or applications. Students should also thoroughly research any scholarship agency to judge its legitimacy.

Financial Aid Standards of Academic Progress

Undergraduate students are required to make satisfactory academic progress toward their degree or certificate. All withdrawals, incompletes, and repeat coursework are taken into consideration when determining SAP (Standards of Academic Progress). Incompletes and withdrawals are counted as attempted credits, not completed credits, and do not affect the cumulative grade point average (CGPA). Transfer credits are counted as both credits attempted and credits earned, but do not affect the CGPA. Nontraditional awarding of credit, including credit by exam and credit for life experience is counted as both credits attempted and credits earned, but does not affect the CGPA. Standards of satisfactory academic progress applies to all students, regardless of enrollment status (full-time, 3/4 time, 1/2 time or less than 1/2 time) or program. All credit hours for which a student has incurred a financial obligation are considered.

Students are considered meeting SAP if they have at least a 2.0 (CGPA) and the percentage of credit hours successfully completed versus the hours attempted is at least at 67%. Students will be reviewed at the end of each semester for SAP. Accountability starts with the student’s entry date at the University.

Students who do not meet the required standards of SAP will receive a Warning notice. While on a Warning status, students are eligible to receive financial aid and may only remain on Warning status for one semester. Students who are still below standards for a second semester will have their aid canceled. Students may appeal the loss of financial aid under the appeal policy outlined below. Students may also use alternate funding to attend and potentially regain SAP status to reestablish aid eligibility (for example; paying on your own or using a private educational loan).

Students are also reviewed each semester for compliance with the Academic Standards. If they are suspended from school under the academic standards policy, they will lose financial aid eligibility for that time period. If readmitted to the University, they may appeal for reinstatement of financial aid.

Maximum Timeframe

All students who receive financial aid must complete their program within 150 percent of the normal program length, as measured in semester credit hours. If they exceed the maximum timeframe, they are subject to the loss of financial aid, which can be appealed following the procedure outlined below.

The maximum timeframe will be adjusted on an exception basis for students who transfer in credits, change their majors or enroll in a subsequent degree.

Appeal and Reinstatement

Students who have lost financial aid eligibility for failure to maintain satisfactory academic progress will be notified in writing of the cancellation of financial aid and urged to contact the Student Financial Services Office. Students with mitigating circumstances wishing to appeal the financial aid cancellation may do so, in writing, to the Student Financial Services Office. Mitigating circumstances may include but are not limited to illness or injury of the student or immediate family member; death of a relative; or other special circumstance. A committee will evaluate the appeal and determine whether the student will be allowed to continue to receive financial aid on either a Probation or Academic Plan status.

The student’s appeal must include the following:

- The reason why the student failed to meet the SAP standard(s) AND

- What has changed in the student’s situation so that they will now be able to meet the SAP standards AND

- Supporting documentation.

The materially complete appeal must be submitted by the start of session two in order to be considered for the current semester. All appeals received after that date will be considered for the subsequent semester. The appeal should be submitted at least two weeks prior to the start of session two, to allow the appeals committee time to review the appeal and request additional documents if necessary. Please refer to the 2024-2025 Academic Calendar for semester and session start dates.

If an appeal is granted and financial aid is reinstated, the student will receive aid on either a Probation or Academic Plan status. A student on Probation is required to regain SAP standing by the end of the probationary semester; the terms of the probation will be included in the notice to the student when the appeal is granted.

If a student cannot regain SAP standing by the end of one semester, the student will be placed on Academic Plan status. The terms of the Academic Plan will be included in the notice sent to the student when the appeal is granted, and may include 100% completion (no W, I, NC or F grades) and a specified minimum semester GPA. The Academic Plan is structured to assist the student in regaining SAP status by a projected point in time not to exceed the Maximum Timeframe. Students must be in a declared program of study to qualify for an Academic Plan; students with an undecided major must declare a specific program of study (major) before an Academic Plan can be established.

Student progress will be reviewed every semester while on Academic Plan. If a student fails to meet the requirements of the Academic Plan, they will become ineligible for financial aid and can appeal a second time. If a second appeal is approved and the student resumes their education on an academic plan status and fails again, a third appeal may be permitted for students who have stopped out for a minimum of three years. If an appeal is denied, the student may resubmit an appeal to be considered for the subsequent semester.

Financial Aid Verification Policy and Procedures

The Department of Education defines “verification” as a process where your school confirms the data reported on your FAFSA. Federal regulations provide Davenport University both the authority and the responsibility to contact you for documentation that supports income and other information that you reported. Schools are required to verify selected student information prior to disbursing aid.

Students are expected to provide required documentation of certain items at the time of application. Normally this documentation should be submitted within one to two weeks of the request. However, sometimes it is necessary to contact outside sources, which could result in additional delays. Financial aid will not be disbursed until all required documentation is reviewed by the Student Financial Services Office. Since funds are limited, students may stand to lose access to some funds, such as institutional scholarships/ grants and some state and federal programs, if documentation is not submitted promptly.

It is Davenport University’s policy to provide students (either in person, by mail, online, or by email) with a clear understanding of the forms and other documentation needed to verify their applications. This documentation may include, but is not limited to, federal income tax transcripts and other nontaxable income source documents, proof of identity, signed statement of academic intent. If students are unsure of what is needed, they should contact their student financial counselor for further explanation until all matters are resolved.

If students’ submitted data fails to meet requirements, the Student Financial Services Office staff will contact the student, either through a letter to the address on record or by telephone or email. Students can also review account information by logging into the Student Connection. (If corrections must be made to the application, it is necessary for the student and parents [if applicable] to sign the appropriate documents and resubmit them for correction and/or evaluation.) After the verification procedures are complete, students will receive notification confirming aid eligibility for federal, state, and institutional aid.

Final awards are not made until the verification process is complete.

Davenport University is required by federal regulation to make referrals to the U.S. Office of Inspector General if it is suspected that aid was requested under false pretenses. Davenport University takes very seriously the proper stewardship of federal funds and will cooperate with government agencies in the prosecution of students who were found to have provided falsified data. If during verification an overpayment situation does occur, the University will make every effort to collect the overpayment. However if it is not collected, the University may refer the case to the U.S. Office of Inspector General if more than $25 is involved.

Academic Year

Davenport University defines the academic year as two semesters, generally fall and winter. The spring/summer semester is optional for students and will be added to the end of an academic year.

Disbursement of Financial Aid

Most financial aid is directly credited to the student’s account each semester. The credit will appear when aid is disbursed to the student account during the second week of each semester/session. Funds will not be credited until all requested documentation is received and verified. Federal Direct Loan disbursements are made at the beginning of the fourth week of the semester/session. Alternative loans are sent directly to the University through electronic fund transfers. If the disbursement is by check, prompt endorsement of the loan check is necessary.

Campus employment earnings are paid directly to the student and not credited to the student’s account. Any financial aid monies credited to the student’s account not needed for direct institutional charges will be refunded to the student, according to federal regulations. Any credit balances remaining on the account at the end of a semester will be refunded, provided that the student has successfully completed the semester (i.e., not completely withdrawn from the University or dropped to less than half-time status during the semester).

Financial aid and outside awards are applied to the student’s account in the following order:

- Federal and state grant aid is applied first.

- MTG/MCS/MAS/TIP is applied to the tuition balance only.

- Federal Pell and Federal Supplemental Education Grant funds are applied next and may be used to cover campus housing and/or fees or books.

- Other outside funds, such as Vocational Rehabilitation, agency funding, or BIA awards, are applied after other grant aid. Generally such agencies are billed for the tuition due after all other grant aid has been applied to the student’s account. (Some outside awards may have restrictions, such as covering only tuition and books.)

- Most institutional scholarships/grants have both per semester and annual limits (details available on the Davenport website) and are applied to a student’s account to cover any balance due only after all federal and state aid, excluding student loans and work-study, have been applied. Institutional scholarships will not result in a refund to the student. External scholarships (e.g. Rotary Clubs, churches, etc.) can be used to cover other University costs such as books, housing and food, but will not result in a refund to the student.

- Tuition grants given by the University are applied after all other grants and scholarships are applied to charges. Students can receive only one DU institutional scholarship within the award year. If a student qualifies for multiple scholarships, the student will receive the most beneficial scholarship. Students who are eligible for both a DU academic scholarship and a tuition grant due to a Davenport partnership agreement will receive the more beneficial program.

- Student loans are applied to cover any remaining balance on the student’s account as they are received and properly endorsed, if applicable.

Note: If an outside funding agency specifically requests a different order of application, the Accounts Receivable Office must receive written confirmation from the agency before authorizing an exception.

Required Annual Notification of Authorization Provisions

To all students and parents: If you give Davenport University written authorization (1) to use Title IV federal student aid funds to pay for charges other than tuition and fees, such as books, and/or (2) to hold any financial aid funds in excess of the current semester charges on account to be applied to subsequent semester charges, that authorization will be valid during the students’ enrollment at Davenport University. Authorization can be canceled or modified at any time, but will not be retroactive.

Davenport University will credit the amount of a refund due to the student against the amount of unpaid charges or non-institutional charges owed to the University.

Any interest earned on funds held on account is retained by the University. For further information, contact the Accounts Receivable Office at 6191 Kraft Ave. SE, Grand Rapids, MI 49512.

Course Program of Study (CPOS)

Course Program of Study (CPOS) is a federal requirement that only courses that count toward a student’s program of study are counted in the student’s enrollment status when determining Title IV aid eligibility. At Davenport University, CPOS applies to federal and state aid. CPOS does not affect institutional or athletic aid.

Repeat of Courses

Financial aid may be used for one repeat of a previously passed course. A student financial counselor can assist students with determining if a repeated course is eligible for aid.

Financial Aid History

Davenport University may need to obtain financial aid history information for any college(s) attended during the current award year, before disbursing financial aid. This information is obtained from the NSLDS (National Student Loan Data System) and can also be viewed by the student at NSLDS.

Student Classification

- Freshman 0-30 credits

- Sophomore 31-60 credits

- Junior 61-90 credits (enrolled in bachelor’s program)

- Senior 91+ credits (enrolled in bachelor’s program)

Enrollment Status

Many aid programs prorate according to a student’s enrollment status. The status is determined by the number of credit hours in which a student is enrolled in the semester. For undergraduate students, enrollment status is as follows:

- Full-time = 12 credits or more per semester

- Three Quarter Time = 9-11 credits per semester

- Half Time = 6-8 credits per semester

- Less Than Half Time = 1-5 credits per semester

Tuition Refund, Repayment, and Withdrawal Policy

Official notice of all withdrawals, failure to attend or schedule changes (including no attendance in any class[es]), must be made in writing or in person to Advising. If you do not submit formal schedule changes, withdrawals, etc. in person or in writing to your advisor, you will be fully charged and not eligible for a tuition refund.

How Are Tuition Refunds Calculated?

Refunds are calculated based on the day you submit written or in-person notice to your DU advisor. The date of official notice is used to calculate your refund amount, which is prorated. No refunds will be given without submitting written or in-person notice, except for Administrative Withdrawals in accordance with the Undergraduate Attendance Policy.

When Will I Receive My Tuition Refund?

Refunds, if applicable, will be made within 30 days of receipt of official notification. Refunds are based on the full tuition charge per course only. Fees, housing, food and books are nonrefundable.

Can Tuition Refunds be Applied to New Classes?

If you are eligible for a refund and are not withdrawing from DU, you may want to have the full tuition amount (that was paid with personal funds) credited against tuition charges for future semesters. If you choose to use the credit for an upcoming semester, you must submit a written request to the Accounts Receivable Office via email at refunds@davenport.edu. You will not receive a refund to your Panther OneCard or personal bank account, but your full tuition credit as described will apply toward another DU class(es).

What if I Disagree with a Refund Calculation?

If you believe you are entitled to an exception to the refund policy:

- Complete the Charge Appeal Form and provide supporting documentation explaining any extenuating circumstances on which the appeal is based.

- Students have up to 30 calendar days following the end of the semester in question.

- Students also receive a written decision on their appeal within 45 business days, based on the Appeals Committee review schedule.

- Students are allowed two (2) appeals for their lifetime at Davenport University.

If You Withdraw and Are a Financial Aid Recipient

When a financial aid recipient withdraws from all classes or does not complete all classes for which they are scheduled through the 60 percent point in time of the semester, the University calculates an amount to be returned based on the Refund, Repayment, and Withdrawal Schedule. The University calculates the amount to be returned in accordance with applicable federal and state regulations.

The financial aid earned by the student before withdrawal is determined by calculating the amount of the semester completed as of the date of official notice of withdrawal. If the amount of federal aid disbursed exceeds the amount of federal aid earned as of the date of withdrawal, either the University or the student, or both, are required to return some portion of federal aid. Late disbursements for which students are eligible are required to be included.

When a student withdraws from current classes but is scheduled in a later-starting class for the semester (usually a session 2 class), they will be required to complete an Intent to Attend (ITA) form within one week of withdrawal. If the student does not complete the form or submit it within the required timeframe, any later-starting classes will be dropped without charge to the student.

Loan exit counseling is required for all students who have received Federal loans and are no longer enrolled half-time or have graduated.

Refund Policy

15 week and 12 week Semesters

Class starts on Monday:

- Prior to the first day of class - No Charge

- Between the 1st and 5th day - 10% Charge

- From the 6th through the 12th day - 50% Charge

- From the 13th through the 19th day - 75% Charge

- After the 19th day of classes - 100% Charge

Class starts on another day:

- Prior to the first day of class - No Charge

- Between the 1st and 7th day - 10% Charge

- From the 8th through the 14th day - 50% Charge

- From the 15th through the 21st day - 75%

- After the 21st day of class - 100% Charge

For 10 week and 7 week sessions

Class starts on Monday:

- Prior to the first day of class - No Charge

- Between the 1st and 5th day - 10% Charge

- From the 6th through the 12th day - 50% Charge

- After the 12th day of class - 100% Charge

Class starts on another day:

- Prior to the first day of class - No Charge

- Between the 1st and 7th day - 10% Charge

- From the 8th through the 14th day - 50% Charge

- After the 14th day of class - 100% Charge

Return to Title IV Policy

The amount of the semester students have completed as of the date of withdrawal is calculated by counting the number of calendar days that have elapsed in the semester and dividing that number by the total number of calendar days in the semester. Scheduled breaks of five days or longer are excluded from the calculation. Students who complete a session 1 class(es) and then withdraw from, are administratively withdrawn from, or drop all 15 week, 12 week, 10 week, or session 2 courses will be considered a withdrawal for the semester and a federal return calculation will be completed.

Students who stop attending a course without officially withdrawing will be given a grade of F and the instructor will report a last date of academic activity. This date will be used in calculating the amount of the semester completed for the Return of Title IV Funds calculation.

The amount of the semester completed by the student determines the earned and unearned amounts of aid. If the amount of federal aid already disbursed to the student is greater than the amount the student earned, the unearned funds must be returned by the University or the student or both. If the amount disbursed to the student is less than the amount the student earned, they may be eligible to receive a post-withdrawal disbursement of the earned aid that was not previously received. Students and/or parents will be notified of any post-withdrawal disbursement eligibility for grants and/or student loan funds within 30 days of the date of determination of withdrawal. Post-withdrawal disbursements of grant funds are made automatically within 30 days of the date of determination of withdrawal. The student or parent borrower must respond within 14 calendar days in order to receive the post-withdrawal disbursement of loan funds. For students and parents who have responded to the notification of eligibility for a receive a post-withdrawal loan disbursement, the University will disburse the loan funds within 30 days of receiving the signed acknowledgement.

The unearned percentage of federal aid is multiplied by the charges for the semester and by the total amount of aid disbursed for the student; the University is responsible for returning the lesser of these two amounts. Students may be required to return any unearned aid less the amount returned by the University.

All Return to Title IV calculations are completed within 30 calendar days of the date of determination of withdrawal. Funds are returned to the US Department of Education within 45 calendar days of the date of determination. If a student is required to return funds to the US Department of Education (an overpayment), the student will be notified within 45 days of the date of determination. The student must repay the amount of the overpayment to the university in full within 45 calendar days of the date of the notice, or the debt will be referred to the US Department of Education for collection. In all overpayment situations, the student’s overpayment status will be reported to the National Student Loan Data System (NSLDS). Students in overpayment are not eligible for federal financial aid at any institution.

If the Return to Title IV Funds calculation results in a credit balance on the student’s account, it will be returned to the student (or parent, for a parent PLUS loan) as soon as possible, but no later than 14 calendar days after the calculation is completed.

Federal funds are returned in the following order, both by the University and the student:

- Unsubsidized Federal Direct Loans

- Subsidized Federal Direct Loans

- Federal PLUS Loans

- Pell Grants

- Iraq & Afghanistan Service Grant

- Federal SEOG

- TEACH Grant

- Other federal aid programs

Students will receive a written notice of any federal funds returned by the University. Invoices for any balance owed to the University will be sent out according to Accounts Receivable Office policy. Any funds left on account at the University as a credit balance at the time of withdrawal will be used first to satisfy unpaid charges owed the University.

At the end of every semester, students who withdrew unofficially from the University (that is, stopped attending all classes before the end of the semester) may be required to have a return of federal funds calculation performed if the documented last day of attendance, as reported by the faculty, was on or before the 60 percent point in time of the semester/session. The calculation procedures outlined above are then followed and the student is notified of any federal funds returned on their behalf. If it is determined that a student never attended a class or classes, the financial aid will be reduced according to the student’s revised enrollment status.

No adjustments to charges, tuition, fees, etc. are made for students who stop attending without official notice of withdrawal. An invoice will be sent to students who owe a balance to the University according to Accounts Receivable Office policy. Additional information on the return of federal funds calculation procedures and requirements, including examples, may be obtained by contacting the Student Financial Services Office.

Student Loan/PLUS Credit Balances

After student loans have been disbursed, money not needed for charges will be returned to an enrolled student within 14 calendar days of the date the funds are applied to the student’s account.

Indebtedness

Students who are indebted to the University will not be permitted to re-register, receive a diploma or order an official transcript until all financial obligations are settled. However, a transcript may be sent directly to a potential or current employer. A transcript order may be processed when employment is listed as the order reason, a comment is entered explaining the order is for employment and the recipient is neither the student nor another school. The Registrar’s Office has the discretion to question or reject orders based on history or collaboration with the Accounts Receivable Office.

Scholarships

To be eligible for institutional scholarships, applicants must not be in default on any education loan and must maintain financial aid standards of academic progress. In addition, students must file the FAFSA or a FAFSA waiver. International students are not required to complete the FAFSA. Upon applying for admission to the University, students are reviewed for DU scholarship eligibility. Most institutional scholarships have both per semester and annual limits (details available on the Davenport website) and are applied to a student’s account to cover any balance due only after all federal and state aid, excluding student loans and work-study, have been applied. Institutional scholarships will not result in a refund to the student.

Scholarships do not apply to DU Competency Exams, DSST, CLEP, major field test and other competency-granted credits. Campus-specific scholarships may carry additional criteria and policies outlined through individual applications and applicable policies.

Davenport University provides institutional funding for student scholarships based on several factors that include but are not limited to the following: merit, financial need, and/or other published scholarship criteria. All scholarship applicants must meet the following criteria:

- The student must file the FAFSA (excluding international students) or a FAFSA waiver.

- The student must meet specific criteria and deadline date as required for each scholarship.

- The student must provide the University with all requested information before the scholarship can be awarded.

- The student must maintain standards of academic progress.

- The student must be enrolled at least half-time (minimum 6 credit hours) except for the Study Abroad Grants.

- The award year for scholarships is defined as fall and winter semesters. Any unused funds for the award year may be used spring/summer (not to exceed the per semester maximum or annual limit).

- The student must begin using the scholarship within the award year of selection.

- International and Global Campus students are considered for all Davenport University institutional scholarships.

- Students can receive only one DU institutional scholarship within the award year. If a student qualifies for multiple scholarships, the student will receive the most beneficial scholarship. Students who are eligible for both a DU institutional scholarship and a tuition grant due to a Davenport partnership agreement will receive the more beneficial program.

- Most institutional scholarships have both per semester and annual limits (details available on the Davenport website) and can be used to pay for tuition, fees, and books after all federal and state aid (excluding student loans and work-study) have been applied.

- External scholarships (e.g., Rotary Clubs, churches, etc.) can be used to cover other University costs such as books, housing and food, but will not result in a refund to the student.

NOTE: Information about current Davenport University Scholarships and Grants, as well as the qualifications and criteria for each scholarship, can be found here.

Davenport University Foundation Scholarships

The Davenport University Foundation also provides assistance for student scholarships. These scholarships were established through generous contributions from alumni, friends and companies. To apply, go to the DU Scholarships website, call 1-866-248-0012 or stop in any Davenport admissions office.

DU Foundation Scholarship List

University Fees and Expenses

Davenport reviews fees annually and publishes them by academic year on the website. Students can find the current fees, including course fees and other miscellaneous fees on the Tuition and Fees page of the Davenport website.

Note: All fees and rates are subject to change.

Student Insurance:

See details on Student Insurance here.

Note: All fees and rates are subject to change.

Textbooks

It is the student’s responsibility to obtain a copy of the course textbook and supplemental materials required for the class at least one week before the start of the class.

Tuition

Undergraduate tuition is assessed as a per-credit hour charge. Current tuition rates are available on the Davenport website.

Students should contact the campus they will be attending for specific tuition rates. Tuition must be paid before the start of each semester via the Student Payment Center or by mail with a money order or personal check. Payment Plan details are available in the Student Payment Center or can be obtained from Student Financial Services. Because Davenport University is an independent, nonprofit university, students may be eligible for certain financial aid programs that are not available at public institutions. It is important that students complete a Free Application for Federal Student Aid (FAFSA) to be considered for these programs. The majority of students attending halftime or more receive financial assistance for educational expenses at Davenport University.

Tuition Charges and Refund Policy

Official notice of all withdrawals, failures to attend, or schedule changes outside the normal drop/add processing must be made by direct contact, written or verbal, with the student’s advisor. Failure to do so will result in full charges. The date of official notice is used to calculate all adjustments to charges. Students may not re-enroll for a subsequent semester or receive official transcripts or a diploma unless all balances owed have been paid in full.

Note: Failure to notify the proper office in writing will result in full charges. The date of official notice is used to calculate all adjustments to charges. If applicable, refunds will be made within 30 days of receipt of official notification. Refunds are based on the full tuition charge per course. Specific dates are published by Student Financial Services each session.

(See the Davenport website for current tuition, fees, and Financial Aid information.)

|